Upon completing CSV file uploads, XFlow will automatically generate essential financial statements for the year ending June 30, 2024. Special attention must be given to rectifying double counting pertaining to depreciation expenses and accumulated depreciation for the financial years ending June 30, 2024, and June 30, 2025.

Migration Process:

1. Initial Upload and Depreciation Calculation:

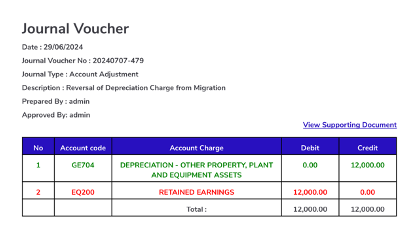

- When you migrate an asset into XFlow for the first time, the system calculates depreciation from the asset's purchase date to the date of uploading into the system. This calculation involves charging depreciation expense and crediting retained earnings over all financial years since the asset's acquisition.

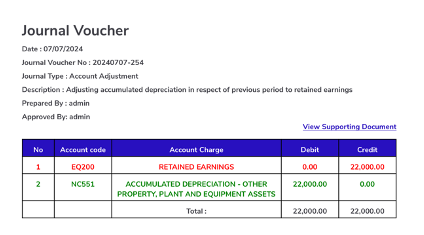

2. Accumulated Depreciation and Retained Earnings Adjustment:

- During the migration process, XFlow will credit the accumulated depreciation for the asset and debit the corresponding entry to retained earnings in the current year. This action is intentional and is designed to maintain system logic.

3. Addressing Double Counting:

- However, as a result of these entries, there may be an overstatement (double counting) of the depreciation expense amount in the income statement of the previous year and the accumulated depreciation in the statement of financial position of the current year in XFlow.

To address these double counting, the following adjustments are necessary in respect of Illustration Limited:

Final Financial Statements:

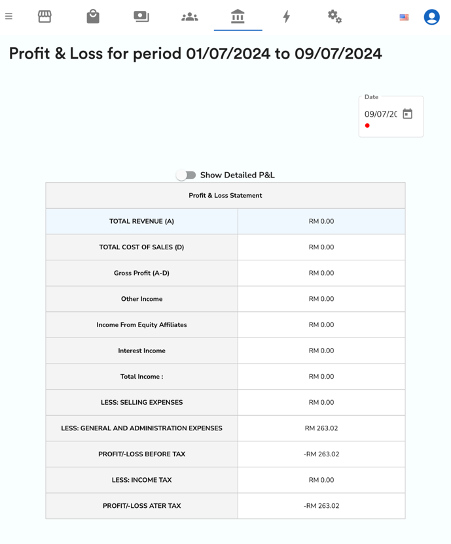

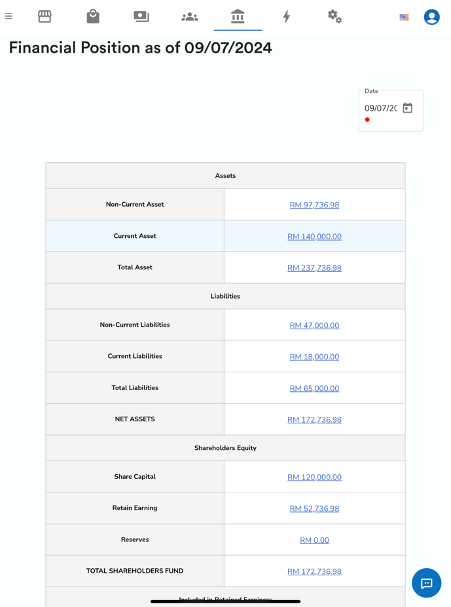

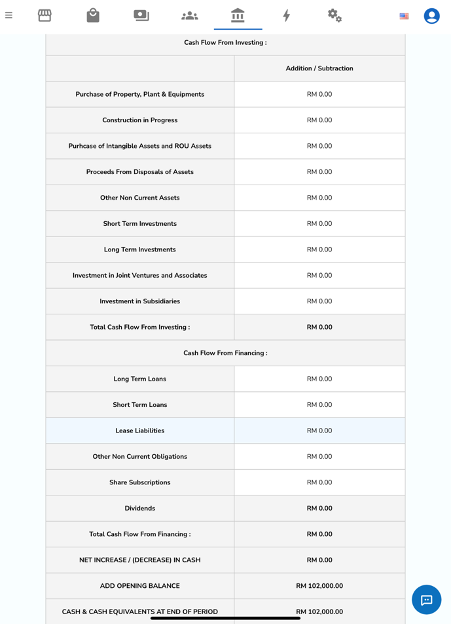

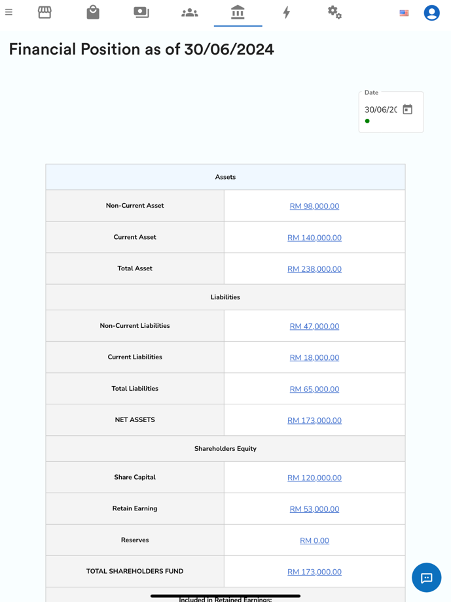

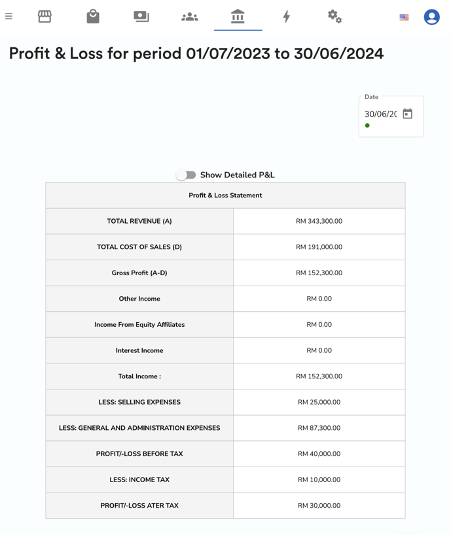

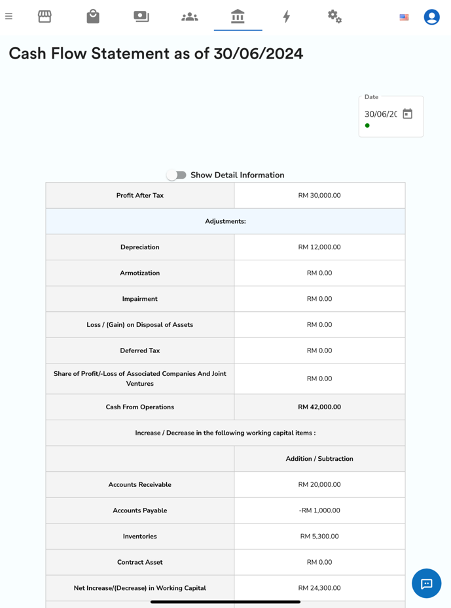

The comprehensive financial statements for Illustration Limited as at 30/06/2024 and post-migration as at 08/07/2024 showcase the culmination of the meticulous data migration and updating process.

Financial Statements as at 30/06/2024

Financial Statements as at 08/07/2024